The True Cost of Commuting in America

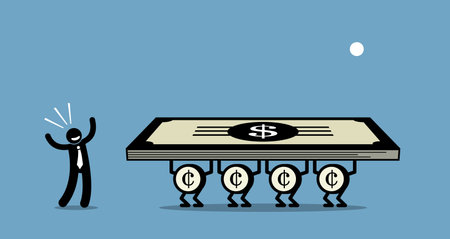

For millions of Americans, commuting is a daily reality that shapes not just schedules, but budgets too. While owning a car may seem like a necessity, the true cost of getting from point A to point B can be surprisingly high when you add up all the expenses involved. Beyond the obvious cost of fuel, drivers must also consider routine maintenance, unexpected repairs, monthly insurance premiums, and even parking fees that can quickly eat into your paycheck. Over time, these costs accumulate into a significant chunk of your income—often more than most people realize. Whether you’re navigating city streets or cruising down the freeway, understanding the full scope of commuting and car ownership expenses is the first step towards transforming your transportation habits and unlocking real savings.

2. Ditching the Drive: Exploring Alternative Commute Options

If you’re ready to revolutionize your daily commute and save money, it’s time to consider the alternatives to solo driving. Not only do these options trim your transportation budget, but they can also boost your physical and mental well-being.

Carpooling: Share the Ride, Split the Costs

Carpooling is more than just a throwback to high school days—it’s a modern way to cut expenses and reduce road stress. By sharing rides with coworkers or neighbors, you can save on gas, tolls, and parking fees. Plus, it’s a great way to build connections while taking cars off congested roads.

Public Transit: Affordable and Accessible

Public transportation systems in many U.S. cities have improved dramatically, offering efficient, cost-effective options for commuters. Whether it’s the subway in New York City, BART in San Francisco, or light rail in Dallas, public transit usually costs far less per month than maintaining a car. And with perks like Wi-Fi on buses or trains, you can reclaim lost commuting time for work or relaxation.

Biking and Walking: Healthy Choices That Pay Off

Choosing to bike or walk isn’t just wallet-friendly—it’s body-friendly too! Many American cities now feature expanded bike lanes and pedestrian paths, making active commuting safer and more convenient. These options eliminate fuel costs entirely and can even help you skip the gym membership.

Comparing Commute Alternatives

| Commute Option | Average Monthly Cost | Main Benefits |

|---|---|---|

| Carpooling | $40-$60 | Split fuel/tolls, social connection |

| Public Transit | $70-$120 | No parking fees, productive time |

| Biking | $0-$20 (maintenance) | Health boost, zero emissions |

| Walking | $0 | Wellness, total savings |

The Ripple Effect of Small Changes

Every mile you don’t drive means dollars saved—not just on gas but also on car maintenance and insurance. By choosing an alternative commute even a few days a week, you’ll notice real savings add up fast while enjoying fresher air and a clearer mind along the way.

3. Mastering the Art of Car Ownership Savings

Car ownership can be a budget buster if you’re not strategic, but with a few smart moves, you can keep more cash in your wallet every month. Start by shopping around for car insurance; rates can vary widely between providers, and bundling policies or maintaining a clean driving record can lead to significant discounts. Don’t be shy about asking your insurer for available deals—many offer savings for low-mileage drivers or students with good grades.

Get Smart With Fuel Efficiency

Gas prices might feel out of your control, but your driving habits aren’t! Simple changes like accelerating smoothly, keeping your tires properly inflated, and reducing excess weight in your trunk can stretch each gallon further. If you’re stuck in traffic often, consider using apps that help you find the quickest routes or avoid rush hour altogether. And if you have the option, carpooling or combining errands into one trip will cut down on both fuel use and wear-and-tear on your vehicle.

DIY Maintenance: Your Wallet’s Best Friend

Don’t underestimate the power of basic do-it-yourself maintenance. Learning how to change your own oil, swap out air filters, and check fluid levels can save you hundreds each year compared to dealership service prices. There are countless free tutorials online tailored for beginners—no need to be a grease monkey to get started! Regular maintenance also prevents bigger, costlier problems down the road.

The Power of Planning Ahead

Finally, plan ahead for major expenses like tire replacements or brake repairs by setting aside a small amount each month in a dedicated car fund. This way, surprise breakdowns won’t throw off your budget or force you into high-interest debt. Remember, mastering car ownership isn’t just about cutting costs—it’s about building confidence and control over one of life’s biggest recurring expenses.

4. Tech Upgrades and Transportation Apps

The digital age has completely reimagined how we get around, and tapping into the right tech can seriously shrink your commuting costs. From ride-sharing apps to smart navigation tools, there’s a whole world of options ready to make your daily travels smoother—and cheaper.

Ride-Sharing Platforms: Share and Save

One of the biggest game changers in recent years has been the rise of ride-sharing apps like Uber, Lyft, and Via. By splitting rides with others heading in the same direction, you’re not only cutting down your expenses but also helping reduce traffic congestion and emissions. Some platforms even offer carpool-specific options or discounted rates for shared rides during peak hours.

Popular Ride-Sharing Apps in the U.S.

| App | Main Features | How It Saves You Money |

|---|---|---|

| Uber Pool | Shared rides with other passengers Discounted fares |

Lower cost per trip by splitting fares |

| Lyft Line | Carpooling feature Real-time matching |

Saves money on regular commutes with shared rides |

| Via | Dynamic routing Flat fares for shared routes |

Affordable rates on popular routes and shared trips |

Route Optimization: Smarter Ways to Travel

If you drive yourself or take public transit, route optimization apps are essential tools for saving both time and money. Google Maps and Waze are two favorites—they use real-time traffic data to help you dodge traffic jams, avoid tolls, and find the quickest (and sometimes cheapest) routes possible. Some public transit apps even calculate fare options so you can pick the most budget-friendly journey.

Key Route Optimization Tools

| App/Tool | Main Benefit | Savings Potential |

|---|---|---|

| Google Maps | Real-time traffic updates Toll avoidance options |

Saves gas and reduces driving time—less wear and tear on your vehicle too! |

| Waze | User-reported hazards Dynamically updated routes |

Avoids unexpected delays that can rack up fuel costs |

| Transit App (city-specific) | Compares public transit routes and schedules Fare calculators included in some cities |

Picks the lowest-cost option for each trip, maximizing savings over time |

Level Up Your Savings With Tech-Savvy Habits

The secret to maximizing these digital tools? Make them part of your routine! Set reminders to check traffic before leaving home. Compare ride-share prices before booking. And if you’re using public transportation, always check for any available discounts through your favorite transit app. The more you embrace these upgrades, the faster your transportation transformation—and savings—will add up.

5. Building Your Transportation Savings Fund

Now that you’ve started saving money on your commute and car expenses, it’s time to take your transportation transformation to the next level by building a dedicated savings fund. Instead of letting those extra dollars disappear into daily spending, open a separate savings account—think of it as your “Transportation Freedom Fund.” This creates a clear boundary between your regular checking and the money you’re intentionally setting aside. Each month, transfer what you save from public transit passes, rideshare credits, or reduced gas and maintenance costs directly into this account. Even small amounts add up fast.

Set inspiring goals for your fund. Maybe you’re dreaming of upgrading to an electric vehicle, planning a cross-country road trip, or simply building a cushion for unexpected repairs. Give your goal a name and visualize the freedom it represents: more choices, less financial stress, and the excitement of turning everyday savings into real-life rewards. Track your progress with apps or spreadsheets—seeing that balance grow is seriously motivating.

If you want to supercharge your savings, try setting up automatic transfers right after payday so you “pay yourself first.” Challenge yourself to increase the amount each time you discover a new way to cut transportation costs. Over time, this intentional approach not only boosts your bank balance but also builds confidence in your ability to manage money wisely. Remember, every dollar saved is a step closer to financial independence—and more adventures on the open road.

6. Real Stories: Everyday Americans Transforming Their Commute

Get ready to be inspired! Across the country, everyday Americans are proving that transforming your commute isn’t just a dream—it’s a smart way to save money and improve your lifestyle. Let’s dive into some real-life stories of people who reimagined their transportation habits, cut costs, and found unexpected benefits along the way.

From Gas Guzzler to Green Machine

Meet Lisa from Austin, Texas. Tired of pouring hundreds into her SUV each month, she made the switch to a hybrid car and started carpooling with coworkers. Not only did she slice her fuel bill in half, but she also received a lower insurance premium and even scored a local tax incentive. Lisa now uses her savings to pay off student loans faster—a win for her wallet and the planet.

Pedal Power Pays Off

John in Minneapolis decided to ditch his second family car altogether after realizing most of his errands were within biking distance. By investing in a quality commuter bike and gear, John eliminated monthly payments for gas, insurance, and maintenance. The result? Over $3,000 saved annually—and he feels healthier than ever before.

The Public Transit Turnaround

Susan, a nurse from Boston, swapped her daily drive for the city’s public transit system. She used her former parking money to fund weekend adventures with her kids. Besides saving cash, Susan gained valuable reading time during her commute—proof that small changes can lead to big rewards.

Your Turn to Transform

These stories show that no matter where you live or what your schedule looks like, there’s always room to rethink your commute. Whether you’re carpooling, biking, or hopping on the bus, every step toward smarter transportation puts more money back in your pocket—and gives you a new story worth sharing.